idaho sales tax rate in 2015

The average local tax was about 001. Idaho has recent rate changes Fri Jan 01 2021.

Minnesota State Chart Indiana State

With local taxes the total sales tax rate is between 6000 and 8500.

. The total tax rate might be as high as 9 depending on local municipalities. Nevada sales tax rate scheduled to decrease to 65 on July 1 2015. You pay use tax on goods you use or store in Idaho when you werent charged or havent paid Idaho sales tax on them.

Fuels Taxes. For full annotations see the source below. Cascade - 208 382-4279.

The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601. The use tax rate is the same as the sales tax rate. Some but not all choose to limit the local sales tax to lodging alcohol by the drink and restaurant food.

Average Property Tax Rates for 2013 01-28-2014 FY. Cities with local sales taxes. Sales.

Combined sales tax rates 2015 State State sales tax Average local sales tax Combined Idaho. This means that these brackets applied to all income earned in 2014 and the tax return that uses these tax rates was due in April 2015. Local Sales Tax Rates.

The Tax Foundation State and local sales tax rates 2017 accessed October 26 2017. Resort cities have a choice in whats taxed and can include everything thats subject to the state sales tax. Idaho Sales Tax Rates.

The 6 sales tax rate in Rogerson consists of 6 Idaho state sales tax. The sales tax jurisdiction name is Twin Falls which may refer to a local government division. Tax Rate.

For tax rates in other cities see Idaho sales taxes by city and county. Average Property Tax Rates for 2018 11-20-2018 Average Property Tax Rates for 2017 02-18-2018 Average Property Tax Rates for 2016 11-16-2016 Average Property Tax Rates for 2015 10-23-2015 Average Property Tax Rates for 2014 01-28-2015 FY. Non-property taxes are permitted at the local level in resort cities if a 60 percent majority vote is obtained.

The current Idaho sales tax rate is 6. There is no applicable county tax city tax or special tax. Prescription Drugs are exempt from the Idaho sales tax.

Plus 6625 of the amount over. The original Idaho state sales tax rate was 3 it has since climbed to 6 as of October 2006. Select the Idaho city from the list.

Apply the taxable income computed in step 5 to the following table to determine the annual Idaho tax withholding. The state sales tax rate in Idaho is 6000. Food sales subject to local taxes.

Combined Sales Tax Range. Pierce ID Sales Tax. Plus 4625 of the amount over.

Youll owe use tax unless an exemption applies. Determine the exemption allowance by applying the following guideline and subtract this amount from the annual wages to compute the taxable income. Idaho has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 3.

Includes a statewide 125 tax levied by local governments in Utah. This covers taxes on hotels booze and sales. Plus 3125 of the amount over.

Contact the following cities directly for questions about their local sales tax. Plus 1125 of the amount over. Crouch - 208 462-4687.

There are a total of 116 local tax jurisdictions across the state collecting an average local tax of 0074. Average Property Tax Rates for 2012 12-11-2013. 6 rows Idahos state sales tax was 6 percent in 2015.

FUN FACTS Several Idaho resort cities and three auditorium community center that service public need and promote prosperity security and general welfare of the inhabitants of the district districts have a local sales tax imposed in addition to the state sales tax. The current state sales tax rate in Idaho ID is 6. Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 85.

Exemption Allowance 3950 x Number of Exemptions. Plus 3625 of the amount over. Idaho ID Sales Tax Rates by City.

Tax rate may be adjusted annually according to a formula based on balances in the unappropriated general fund and the school foundation fund. Average Sales Tax With Local. You can print a 6 sales tax table here.

Read more in our Use Tax guide. Plus 5625 of the amount over.

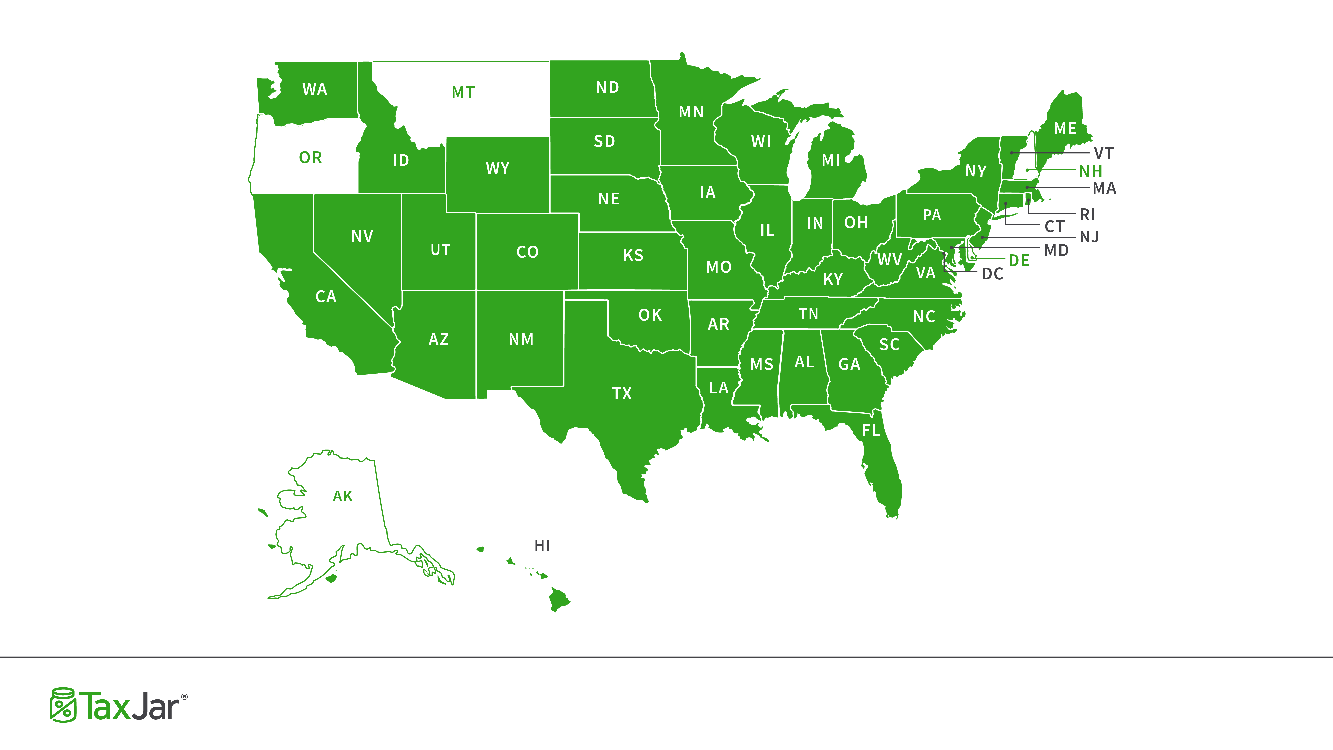

How To Charge Your Customers The Correct Sales Tax Rates

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax Fun Facts

State Corporate Income Tax Rates And Brackets Tax Foundation

Have You Checked Out Our Collection Of Nightlights Lately So Many To Choose From Https Angellandry Scents Scentsy Scentsy Consultant Ideas Selling Scentsy

Historical Idaho Tax Policy Information Ballotpedia

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

Which States Get Most Of Their Revenue From Sales Tax Taxjar

Pin By Barb Hutchinson Idaho Homes On Real Estate Info American Dream Realtors Keller Williams Realty

Littourati Main Page Blue Highways Moscow Idaho Idaho County Idaho Travel Idaho Adventure

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Historical California Tax Policy Information Ballotpedia

Fact 900 November 23 2015 States Tax Gasoline At Varying Rates Department Of Energy

Chart Current Mortgage Closing Costs Listed By State Closing Costs Mortgage Interest Mortgage